LOAN ORIGINATION

DATA-DRIVEN DECISIONING

Proprietary predictive modeling enables real-time automated decisioning and product assignment, while eliminating human error and lowering operating costs.

Unlimited Data Aggregation

Hyphen’s class-leading analytics platform combines third-party data and proprietary input from certified data scientists to aggregate unlimited amounts of data.

Advanced CREDIT MODELING

Combining this data with proprietary credit risk and conversion models developed by Hyphen’s certified data scientists, the Credit Model Engine instantly assigns risk-based product offerings that meet your targeted return thresholds.

ONGOING OPTIMIZATION

Ongoing data acquisition and advanced analytics continually optimize lending performance to maximize profitability.

Lead Scoring

Leads are scored using credit risk and conversion models based on loan application data, prime and non-prime credit bureau data, and thousands of non-credit attributes from external data providers:

ID VERIFICATION

Identity, Address, Phone, Email

ECONOMIC STABILITY MODEL

Employer, Payroll, Economy, Industry

CREDIT RISK MODEL

Attribute-level Scoring Algorithm

CONVERSION MODEL

Attribute-level Scoring Algorithm

CASHFLOW ANALYSIS

Transactional-level Bank Detail

PRODUCT ASSIGNMENT

Credit & Conversion Scores, Cashflow Data

CONVERSION OPTIMIZATION

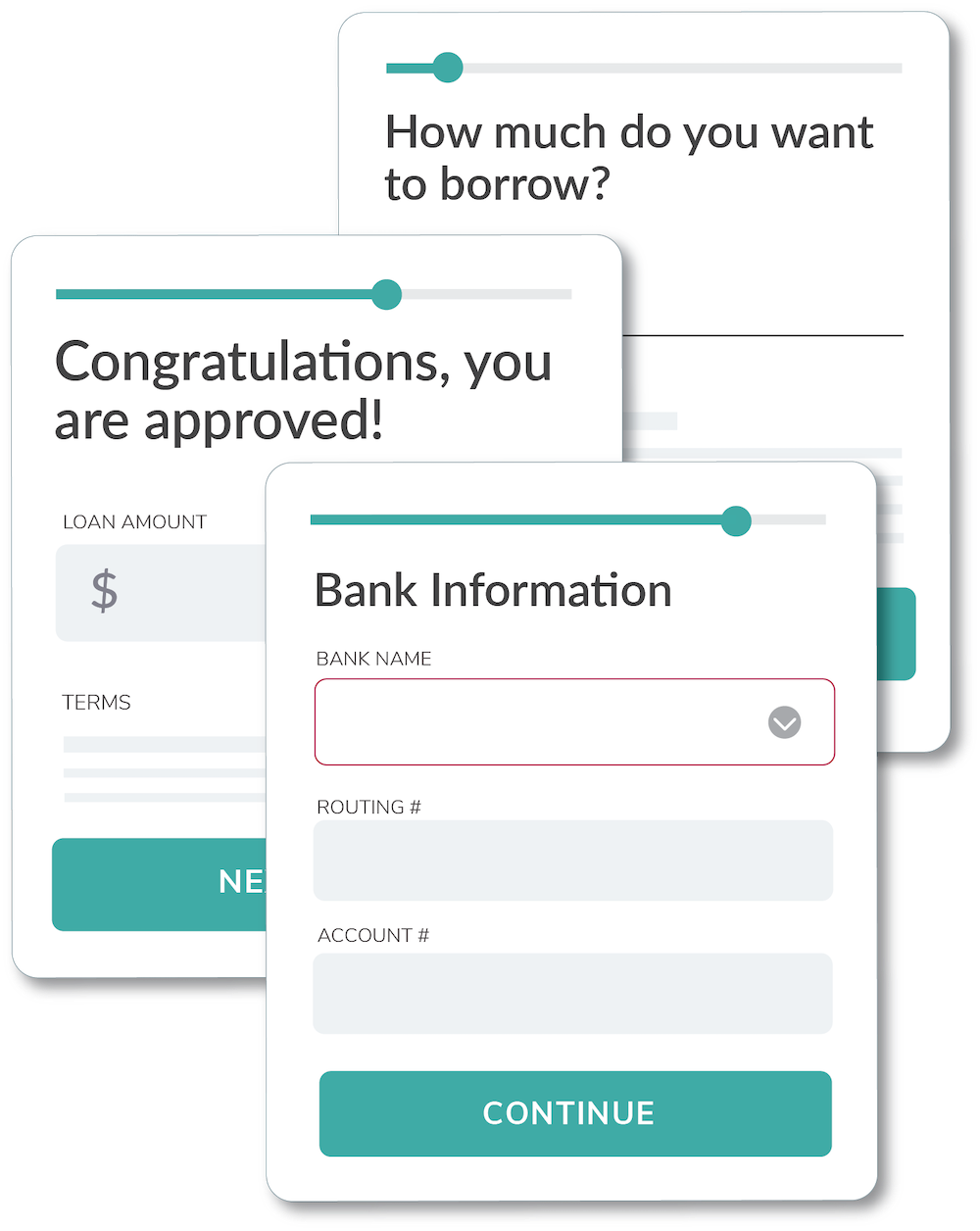

The entire origination journey — from application to funding — is fully automated and can be completed by the borrower in less than 10 minutes.

A Simple, Seamless Process

Traditionally tedious steps of the process — including bank verification, ID authentication, and loan agreements — can be completed on a mobile device with just a few clicks.

AUTOMATED REMARKETING

Automated emails, SMS text, and digital ad campaigns reclaim leads who abandon at any point in the process. Behavior-based sequencing increases conversion by nurturing abandoned leads when and how they are most likely to return and convert.

ENGAGEMENT CONTENT

A 24/7 automated chatbot guides users through the funding process. Clear and concise educational content on the website addresses common borrower questions and concerns, helping users overcome purchase hesitation.

FRAUD PREVENTION

Leading third-party data verification and advanced identity authentication software — including facial recognition, driver’s license verification, banking relationships, and out-of-wallet questions — prevent fraud throughout the process.

COMPLIANCE CERTAINTY

With SOC compliance certification — as well as extensive experience in partnering with lenders and financial institutions — Hyphen helps clients manage and monitor ongoing compliance concerns, including KYC, BSA, Disparate Impact, FinCEN, MLA, OFAC, and more.