SERVICING

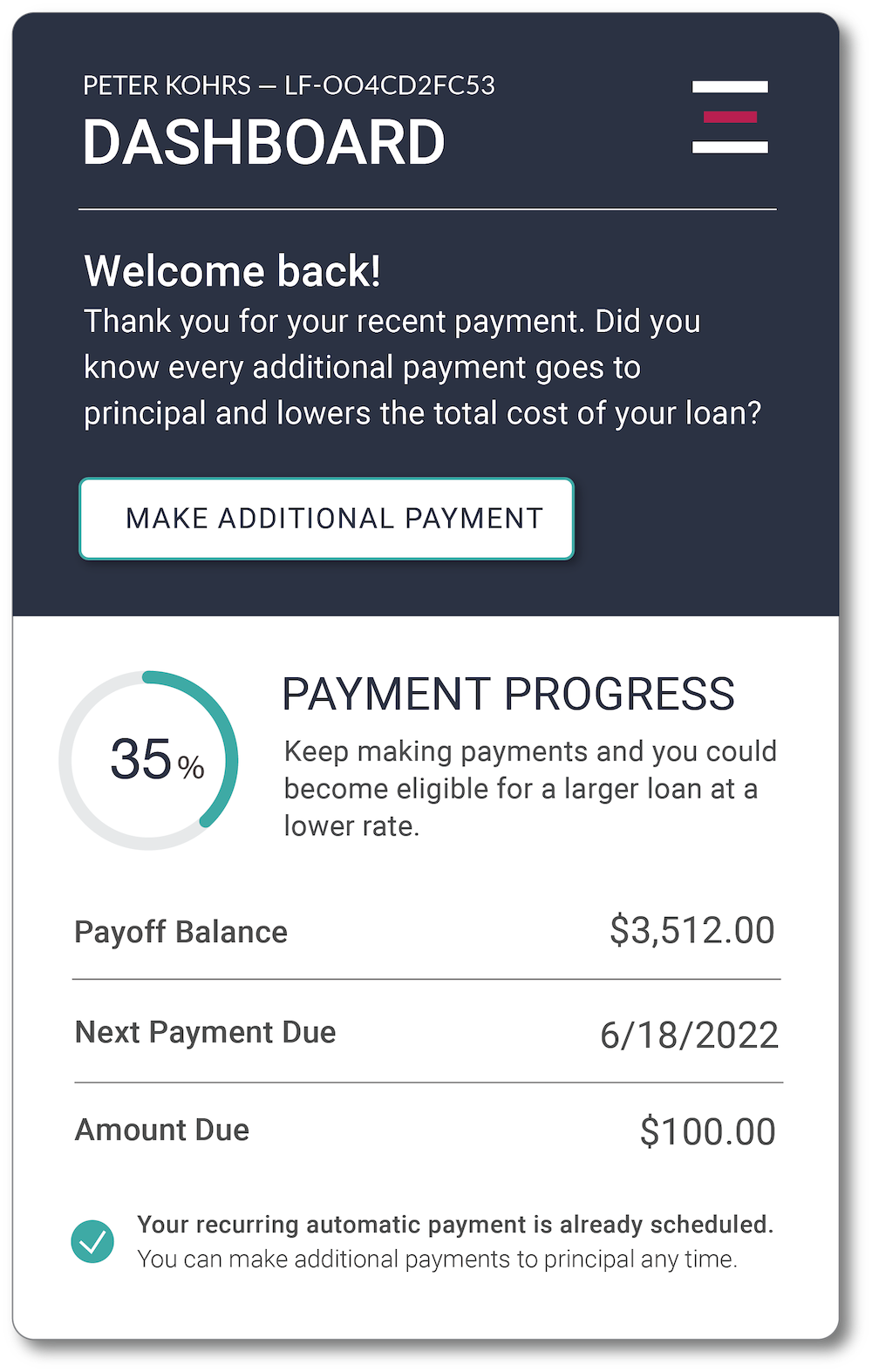

CUSTOMER PORTAL

Significantly reduce manual servicing and improve customer satisfaction with a robust, responsive online customer portal that enables borrowers to quickly and simply self-service their accounts — anytime, anywhere.

- View account status and loan terms

- View payment status, including payment history and upcoming payments

- Make and schedule payments, including pay-in-full options

- Update payment information and enroll in AutoPay

- Access loan agreements

- Apply for additional funds

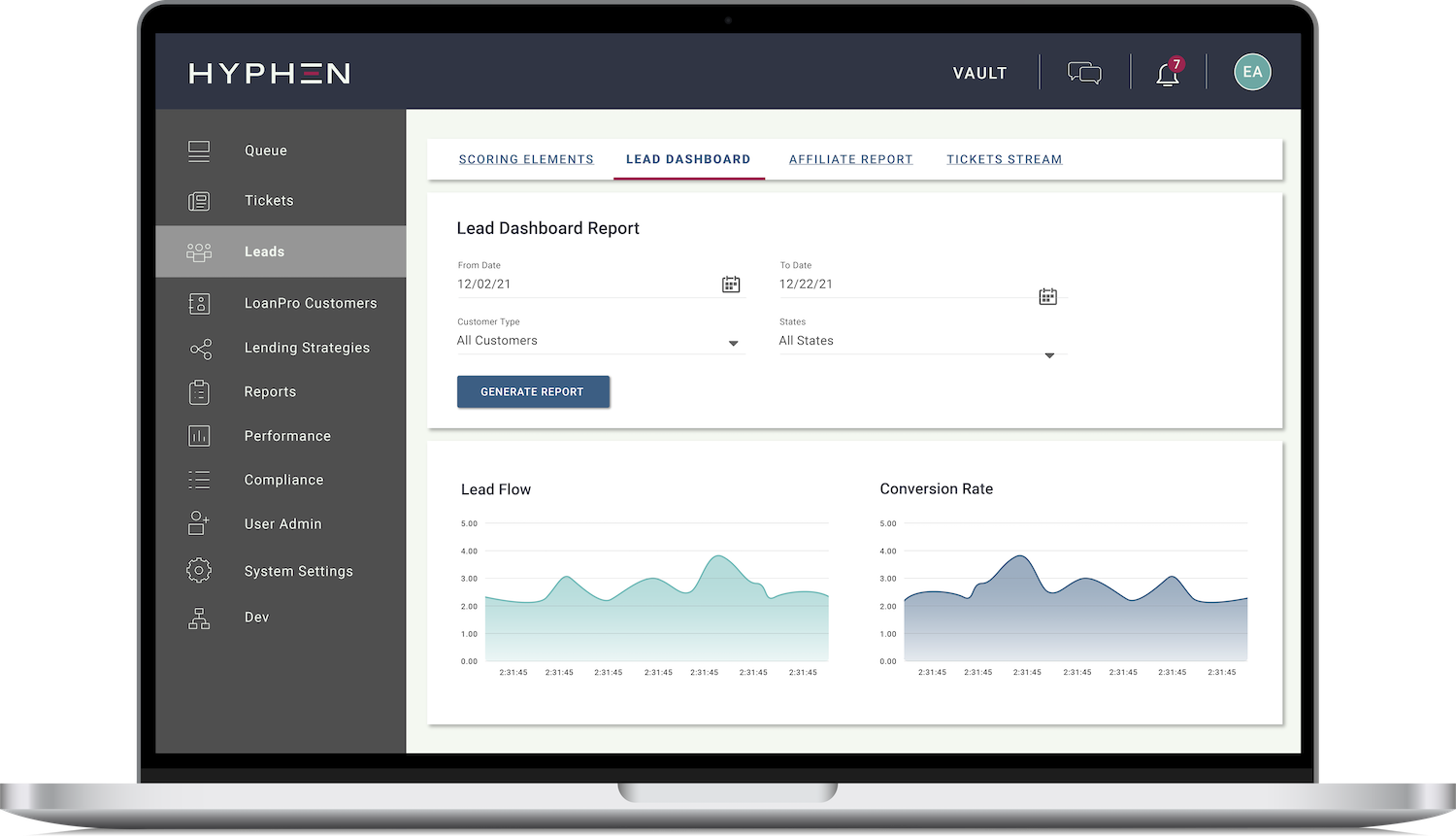

ACCOUNT MANAGEMENT

A comprehensive loan management platform streamlines the entire loan servicing process for the management team and agents, including:

- Customized reporting

- Payment processing tools

- Accounting functionality

- Document storage

- Customer support ticketing system

Onboarding & Retention

Integrated omni-channel integrated marketing campaigns engage your customers via email, text, remote voice mail, chat, and dashboard notifications.

ONBOARDING

Reinforce product understanding and educate borrowers on self-servicing capabilities with customizable onboarding campaigns for new customers.

ENGAGEMENT

Promote positive payment behavior with automated transactional communications, including payment reminders, account alerts, and new product offerings.

RETENTION

Improve customer retention with ongoing communications on product improvement, feedback capture, educational resources, and cross-marketing opportunities.